Elon Musk has a net worth of $197.1 billion according to Forbes.

Musk catapulted to fame through the establishment of some of today’s most groundbreaking tech companies, such as Tesla, a leading electric vehicle manufacturer, and SpaceX, a pioneering space exploration venture.

PHOTO Courtesy | Celebrity Net Worth

Presently, Musk holds the title of the wealthiest individual globally, as reported by Bloomberg, primarily attributable to his approximately 13 percent ownership stake in Tesla, valued at around $74 billion as of 2024.

However, Musk’s business strategies veer towards the unconventional and occasionally provoke controversy.

In 2022, he made headlines by agreeing to acquire the social media giant Twitter in a $44 billion deal, only to later attempt to retract from the agreement.

Ultimately, he acquiesced to proceed with the acquisition under its original terms, just before a Delaware trial loomed.

Further insights into Musk’s trajectory, including his entrepreneurial origins and significant current investments, are detailed below.

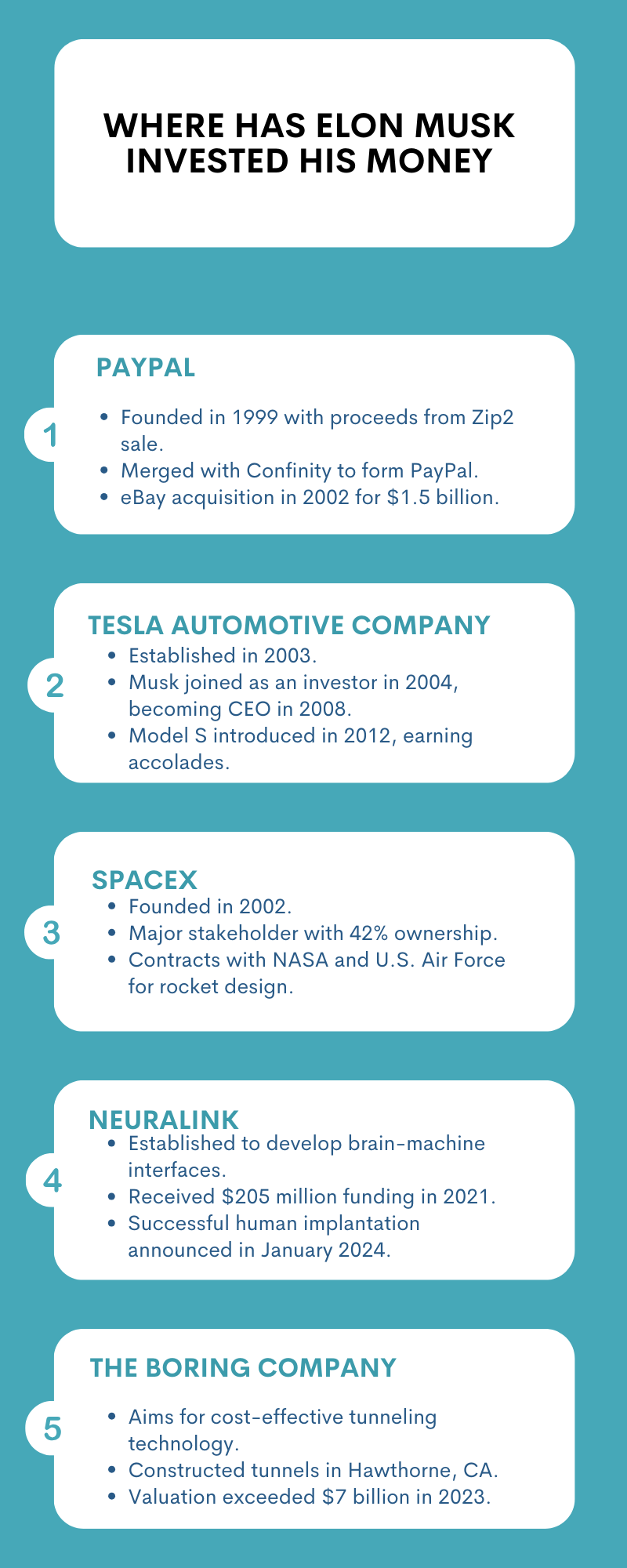

Where has Elon Musk Invested his Wealth

Elon Musk has invested in several prominent tech enterprises, some of which have grown to become major players in the U.S. market.

| Company | Value | Number of Employees |

|---|---|---|

| Tesla | $587 billion | 140,473 |

| SpaceX | $180 billion | 13,000 |

| The Boring Company | Over $7 billion | ~200 |

| Neuralink | $3.5 billion | – |

| PayPal | $68 billion | 29,900 |

Paypal

After the sale of Zip2, a software firm aimed at aiding newspapers in constructing online city guides, to Compaq Computer in 1999, Musk utilized the proceeds to establish X.com.

Subsequently, he merged X.com with the money transfer enterprise Confinity, resulting in the formation of PayPal.

When eBay acquired PayPal in 2002 for $1.5 billion, Musk’s 11.7 percent ownership yielded him approximately $180 million after taxes.

The transaction generated substantial wealth for its founders and early staff, who proceeded to establish and invest in new tech ventures.

This cadre of PayPal founders, including investor and political activist Peter Thiel and Affirm CEO Max Levchin, became known as the “PayPal Mafia.”

Tesla Automotive Company

Tesla, established in 2003, has emerged as a pioneer in electric vehicle production.

Musk initially engaged with Tesla as an investor in 2004, later assuming the role of chairman of its board of directors, eventually progressing to CEO in 2008.

Tesla debuted its inaugural car in 2008, with its Model S, introduced in 2012, earning the distinction of being deemed the best overall car by Consumer Reports.

In the summer of 2020, Tesla claimed the mantle of the world’s most valuable car manufacturer, with its market capitalization surpassing $1 trillion in the fall of 2021 before experiencing a decline in 2022.

As of 2024, the company boasted a market value of approximately $587 billion.

Musk holds an approximate 13 percent ownership stake in Tesla, wielding significant influence within the company, particularly in steering product design, engineering, and global manufacturing of its electric vehicles, battery technology, and solar energy products.

In 2018, Musk and Tesla reached a settlement with the Securities and Exchange Commission (SEC), agreeing to each pay $20 million to resolve securities fraud allegations.

This followed Musk’s tweet asserting the possibility of taking Tesla private at $420 per share with secured funding, a claim lacking sufficient basis.

Additionally, Musk was compelled to relinquish his role as Tesla’s chairman for a three-year period as part of the agreement.

Space X

SpaceX, where Musk serves as CEO and chief designer, focuses on the development of rockets and spacecraft for missions to Earth’s orbit and, ultimately, to other celestial bodies.

Using the majority of his proceeds from PayPal, Musk founded SpaceX in 2002.

Despite being a private entity, Musk held a 42 percent stake in the company through a trust, as per a 2022 filing examined by Bloomberg.

SpaceX has secured contracts with NASA and the U.S. Air Force for rocket design endeavors.

Neuralink

Neuralink, as described on its website, is dedicated to crafting ultra-high bandwidth brain-machine interfaces, facilitating connectivity between human brains and computers.

In 2021, the company disclosed securing $205 million in funding from various venture capital firms and investors, including Google.

Musk envisions Neuralink primarily assisting individuals with brain injuries in the immediate future while concurrently mitigating the risks posed by artificial intelligence to humanity in the long term.

With fewer than 500 employees, Neuralink ranks among Musk’s smaller ventures.

In January 2024, Musk announced the successful implantation of a Neuralink brain device in a human recipient, with the patient reportedly recuperating favorably.

The Boring Company

The Boring Company endeavors to integrate rapid, cost-effective tunneling technology with an electric public transit system, aiming to alleviate urban congestion and facilitate high-speed, long-distance travel.

In pursuit of this goal, the company constructed a 1.15-mile tunnel in Hawthorne, California, designated for research and development purposes.

Presently, it is engaged in the construction of the Vegas Loop, a public transit network situated at the Las Vegas Convention Center.

As reported by The Information, the company achieved a valuation surpassing $7 billion following an employee share sale in October 2023.

This valuation exceeds its appraisal from a funding round in April 2022, during which it amassed $675 million.

Notably, the 2022 funding initiative was spearheaded by Vy Capital and Sequoia Capital, prominent venture capital firms.

ALSO READ